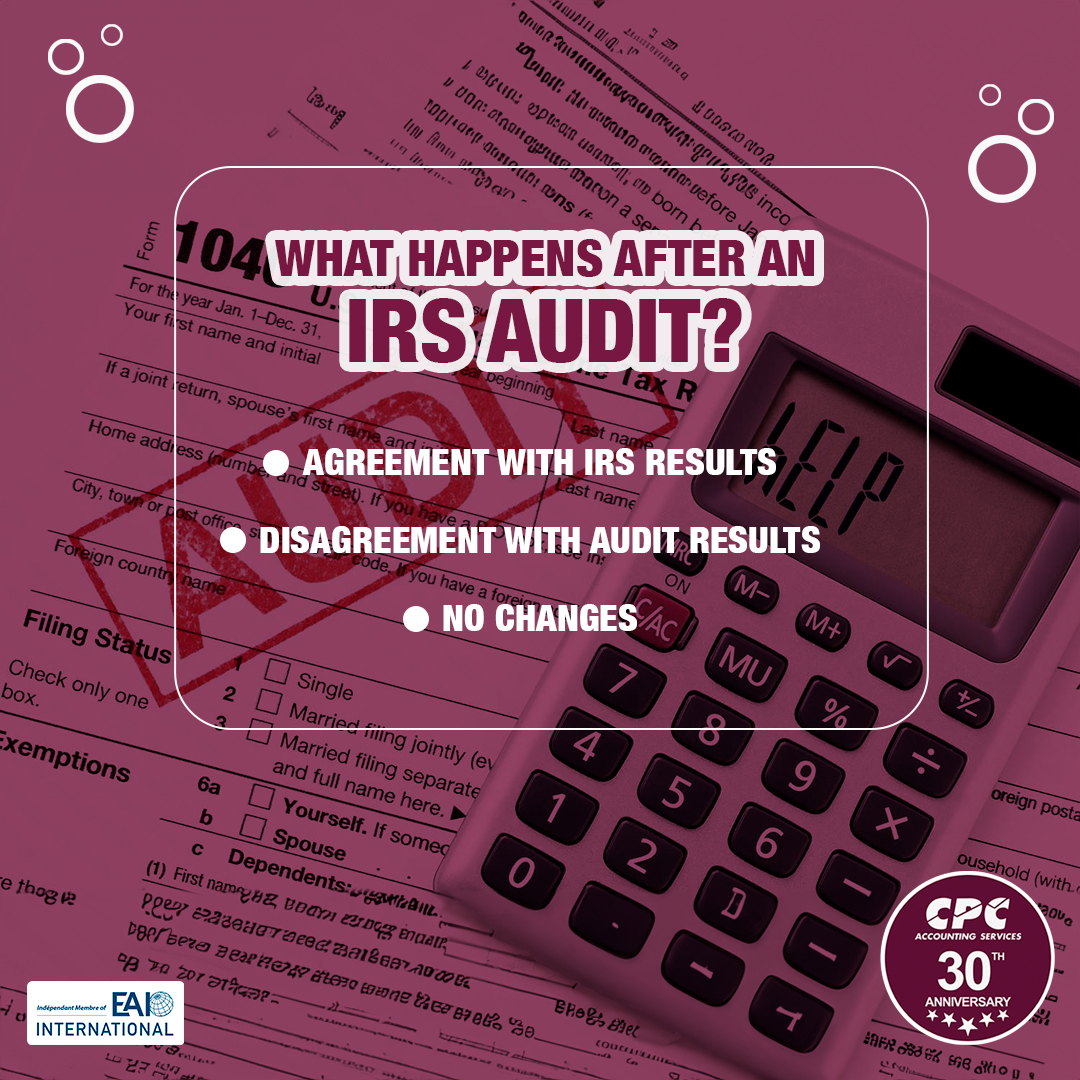

When an IRS audit concludes, here are the three possible outcomes:

-Agreement with IRS Results:

*Sign the examination report.

*If you owe more taxes, various payment options are available, like installment plans or offers in compromise.

-Disagreement with Audit Results:

*Request a conference with an IRS manager.

*Consider taking the matter to court.

*Consulting a tax professional is highly recommended for navigating these options.

-No Changes:

*If all your claims are substantiated, the IRS may make no changes to your tax liability.

*This is common when your filings are accurate and timely.

Stay prepared and know your options!

No comment